You might be overlooking obscure add‑ons that can materially elevate your UAE motor cover: accident forgiveness protects your no‑claim discount, key and personal belongings cover prevents steep replacement costs, and legal/third‑party liability extension limits your financial exposure from costly lawsuits; assessing these options empowers you to reduce risk, avoid surprise bills and tailor protection to your driving profile.

Key Takeaways:

- Zero-depreciation (depreciation waiver) prevents deductions on replaced parts, preserving full claim value for newer or high-value cars.

- Engine and transmission protection covers mechanical failures and sand/water damage often excluded from standard policies.

- Key replacement and emergency locksmith cover reduces high out-of-pocket costs for lost, stolen, or broken keys.

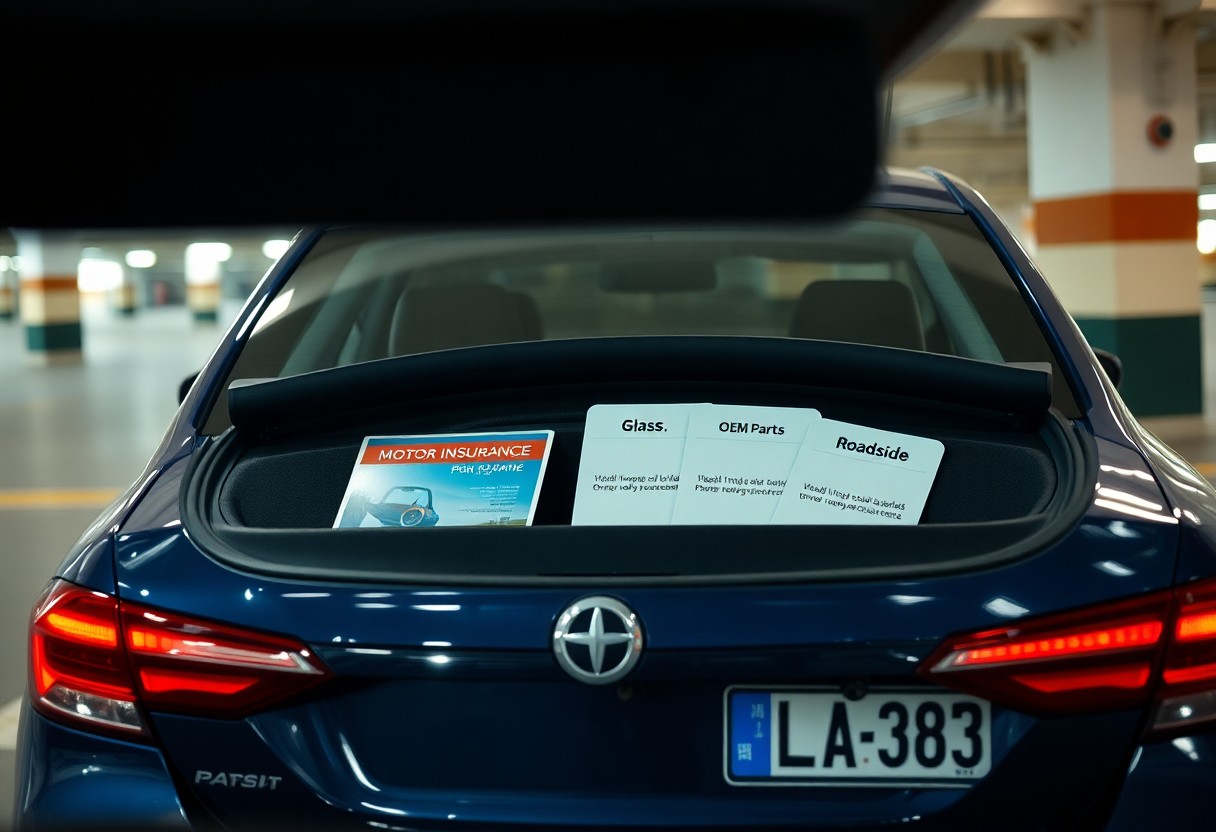

- Roadside assistance and desert/off‑road recovery provide towing, winching, fuel delivery and on-site fixes for remote UAE/GCC travel.

- OEM/agency repair and genuine parts cover ensures manufacturer repairs and parts, helping maintain resale value and warranty conditions.

Understanding UAE Motor Insurance

When you compare policies in the UAE, note that third‑party liability is legally required, covering damage to others and medical costs; meanwhile, comprehensive plans protect your vehicle from accident, theft, fire and vandalism. You can often secure a no‑claims discount (NCD) of 20-60%

Basic, mandatory third‑party cover pays for the other party’s vehicle and injury costs but won’t cover your repairs or theft

Choosing comprehensive cover means you’ll get repairs, theft and accidental damage paid for, plus optional protections like windscreen, roadside assistance and agency repairs; in practice this reduces out‑of‑pocket risk when a single incident can cost several thousand dirhams. If you drive a loaned, leased or high‑value vehicle, a comprehensive policy often prevents a severe financial hit after a claim. Digging deeper, you should evaluate limits, deductibles and specific add‑ons: for example, agreed value cover matters for older or modified cars, while replacement vehicle cover keeps you mobile during lengthy repairs. Insurers in the UAE also differ on fault‑apportionment and salvage rules-one provider may offer full agency repairs with OEM parts, another may restrict workshops-so compare sample claim scenarios (minor bumper repair vs total loss) and run numbers: premium vs expected excess and NCD impact to pick the arrangement that protects your wallet and keeps compliance with UAE law. When comparing UAE motor policies you should prioritise add-ons that match your driving patterns-daily commuters may value roadside assistance, while occasional drivers often need personal accident cover. Many insurers offer modular choices like windscreen cover, agency repairs, and legal liability for passengers; limits and excesses vary, so compare coverage amounts, exclusions and policy excesses rather than price alone. Personal Accident Cover provides lump‑sum payouts for death or permanent disability; policies in the UAE commonly offer limits between AED 50,000-500,000. You’re covered whether you’re driving or a passenger, and some plans add daily hospital cash-typically AED 100-500 per day. Check age limits, exclusions for reckless driving, and whether compensation scales with the degree of disability. Roadside Assistance Services include towing, jump‑starts, fuel delivery, flat‑tyre change, and locksmith help; typical urban response times are under 60 minutes and towing often covers up to 50 km. You’ll avoid expensive out‑of‑pocket tows and emergency repairs; confirm annual call‑out limits, on‑site repair caps, and whether a replacement vehicle or accommodation is provided after a breakdown. Consider a breakdown on Sheikh Zayed Road at 2am: a private tow for 30 km can cost AED 300-600, plus delay. If your add‑on includes 24/7 dispatch with GPS and mobile mechanics who fix up to 70% of minor faults on site, you save both time and money. Also compare free‑tow limits (e.g., three tows/year), response‑time guarantees, and whether the insurer allows towing to your preferred garage. Often overlooked extras can save you big sums: new car replacement for write-offs within the first 12-24 months, off-road coverage for dune trips and wadis, and OEM-parts endorsements that preserve resale value. You should compare added premiums (commonly 3-15%) against real costs like depreciation, recovery bills, or non-genuine repairs to decide which obscure add-ons actually benefit your situation. If your vehicle is declared a total loss within the first 12-24 months or up to ~20,000 km, this add-on replaces it with a brand-new identical model rather than paying current market value minus depreciation. You’ll find it particularly valuable if you financed the car; insurers often charge a modest extra premium (typically 1-5%) but avoid large out-of-pocket gaps when insurers apply depreciation. Standard UAE motor policies commonly exclude driving on dunes or unpaved trails, so adding off-road cover protects you for activities like dune bashing, desert tracks and wadis, covering mechanical damage, towing and recovery. Expect insurers to apply endorsements, higher excesses, and premium uplifts (often 5-20%); organized racing or competitive events usually remain excluded. In practice, off-road claims can involve expensive recoveries and gearbox or axle repairs; you might face bills of AED 2,000-10,000 for towing plus parts. You should check policy conditions: some require declared off-road use, restrict certain modifications, or demand professional recovery receipts. Choosing the right endorsement means confirming limits, excesses and whether third-party recovery or hire costs are included before you head into the desert. By adding specific riders you cut exposure to UAE risks like sand ingress, coastal corrosion and seasonal floods, and you can tailor protection to how you actually use the car. For many drivers, add-ons such as zero-depreciation, roadside assistance and agency-repair cover reduce out-of-pocket costs by up to 70% on typical claims, speed up repairs, and prevent claim disputes that might otherwise leave you paying thousands in unexpected fees. If you drive for ride-hailing platforms or run a modified/luxury vehicle, standard policies often leave gaps; adding a commercial-use rider or agreed-value cover closes them. For example, using a private policy while working for platforms like Careem can lead to claim denial, whereas a commercial rider for 12+ hours daily use preserves payouts. Classic-car owners benefit from agreed-value clauses that protect against depreciation and volatile replacement costs. While add-ons typically raise premiums by 10-30%, they often save far more on a single sizeable claim: zero-depreciation can reduce parts bills for newer cars by 60-80%, and roadside assistance prevents towing fees of AED 300-800. Choosing the right combination lets you cap your maximum cash exposure and avoid situations where a denied claim leaves you with a large bill. Consider a 3‑year SUV with a repair bill of AED 12,000: depreciation and parts shortfalls might leave you paying ~AED 7,000-8,500 without zero-dep, plus the excess. If that add-on raises your annual premium by AED 400-800, a single claim often recoups the extra cost. Use expected annual mileage and claim-frequency (typical UAE average: 1-2 claims per 5 years) to model payback and decide which riders deliver the best ROI for your driving profile. When deciding on add-ons, match them to your vehicle value, driving frequency and budget. If your car is over AED 100,000 or you drive >15,000 km/year, prioritize gap cover and accident forgiveness. Compare quotes: add-ons can raise total premium by 10-40%, while targeted options like roadside assistance often cost only AED 100-300 annually. Check sub-limits, waiting periods and how each add-on affects your no-claims discount. Your daily mileage, night driving frequency and whether you use the car for work determine which add-ons benefit you most. For example, if you average 60 km/day commuting or do app-based deliveries, add-ons covering commercial use or higher third-party limits protect you. Short trips in dense urban areas increase minor accident likelihood, so consider windscreen and bumper cover to avoid frequent out-of-pocket repairs. Ask brokers and insurer representatives to run a side-by-side comparison that highlights exclusions, sub-limits and impact on your premium. A professional can flag hidden gaps like exclusions for commercial use or passenger-for-hire, and quantify savings-many independent brokers identify average client savings of 10-20% when optimizing add-ons. Always get endorsements in writing and verify claim processes before adding cover. Require clear answers on deductibles, per-claim sub-limits and whether add-ons alter your excess; ask “Will this increase my excess by AED X?” where applicable. Demand the insurer’s claim settlement ratio, average payout time and examples of past claims involving the add-on. If you drive commercially, insist they review your employment contract-one delivery driver discovered his insurer denied a AED 75,000 claim due to undeclared commercial use. Keep written quotations to compare. Drawing together the options, you should evaluate lesser-known add-ons-engine protection, key replacement, roadside assistance with international coverage, legal-expense cover and no-claims discount protection-that can cut your out-of-pocket costs and broaden protection; compare premiums, exclusions and provider reputation so you select add-ons that genuinely elevate your UAE motor insurance and suit your driving profile. A: Several specialized covers address sand and desert conditions: sandstorm/dust ingress cover reimburses repairs for bodywork and mechanical damage caused by blowing sand; engine protection or ingress cover pays for repairs if sand or dust enters the intake or turbo; and off-road/4×4 endorsement extends cover for driving on dunes or unpaved terrain that standard policies often exclude. These add-ons usually have age and vehicle-condition limits, may require evidence of restricted off-road use, and can carry higher premiums-check specific exclusions (e.g., competitive dune events) and documentation needed for claims. A: Zero-depreciation reimburses the full cost of replaced parts without applying depreciation, so plastic, rubber and metal components are paid at full invoice value rather than a depreciated rate common in standard comprehensive policies. It typically applies to vehicles under a specified age (often 3-5 years) and to select parts; labour or accessory costs may still be excluded. The add-on raises premium but reduces out-of-pocket costs at repair time; compare the extra annual premium versus likely spare-part depreciation before buying. A: Yes-key and remote replacement cover reimburses the cost of replacing lost or stolen keys, reprogramming transponders and locksmith services; lockout assistance covers emergency opening if keys are locked inside. Limits, waiting periods, and proofs of ownership are common requirements; replacement of bespoke or high-end smart keys can be costly so confirm caps and whether replacements must use dealer parts or approved vendors. A: Rental-car reimbursement or vehicle hire cover pays for temporary transport while your car is being repaired following an insured claim, within specified limits and timeframes. Emergency accommodation/onward travel and repatriation endorsements cover hotel costs, alternative travel arrangements or repatriation if an accident makes continuation of a trip impossible. Check per-day caps, maximum number of days, whether cover applies after third-party fault only, and documentation required (repair invoices, police report). A: GCC extension or cross-border cover extends third-party liability and sometimes comprehensive protection to neighbouring GCC countries and supplies required documentation; verify which countries and whether green card-type proof is provided. Commercial-use or ride-hailing/delivery endorsements adjust cover for business exposure-higher liability limits, goods-in-transit cover, and employer liability for drivers. Using a private policy for business without endorsement can void claims, so declare the precise use and secure the right endorsement to avoid denial.Overview of Basic Coverage

Importance of Comprehensive Policies

Common Add-Ons to Consider

Personal Accident Cover

Roadside Assistance Services

Obscure Add-Ons That Make a Difference

New Car Replacement

Off-Road Coverage

Benefits of Customizing Your Policy

Tailored Coverage for Unique Needs

Cost-Effectiveness of Add-Ons

How to Choose the Right Add-Ons

Assessing Personal Driving Habits

Consulting with Insurance Experts

To wrap up

FAQ

Q: What obscure add-ons protect my car from sand, dust and desert-driving damage in the UAE?

Q: How does zero-depreciation (nil depreciation) differ from standard comprehensive cover and when is it worth adding?

Q: Are there add-ons for key loss, remote/keyless entry replacement and lockout assistance?

Q: Can motor insurance include hire car, onward travel or accommodation after an accident in the UAE?

Q: What niche add-ons help if I drive cross-border in the GCC or use my car for business, delivery or ride-hailing in the UAE?

0 Comments